Harley Davidson Financial Analysis

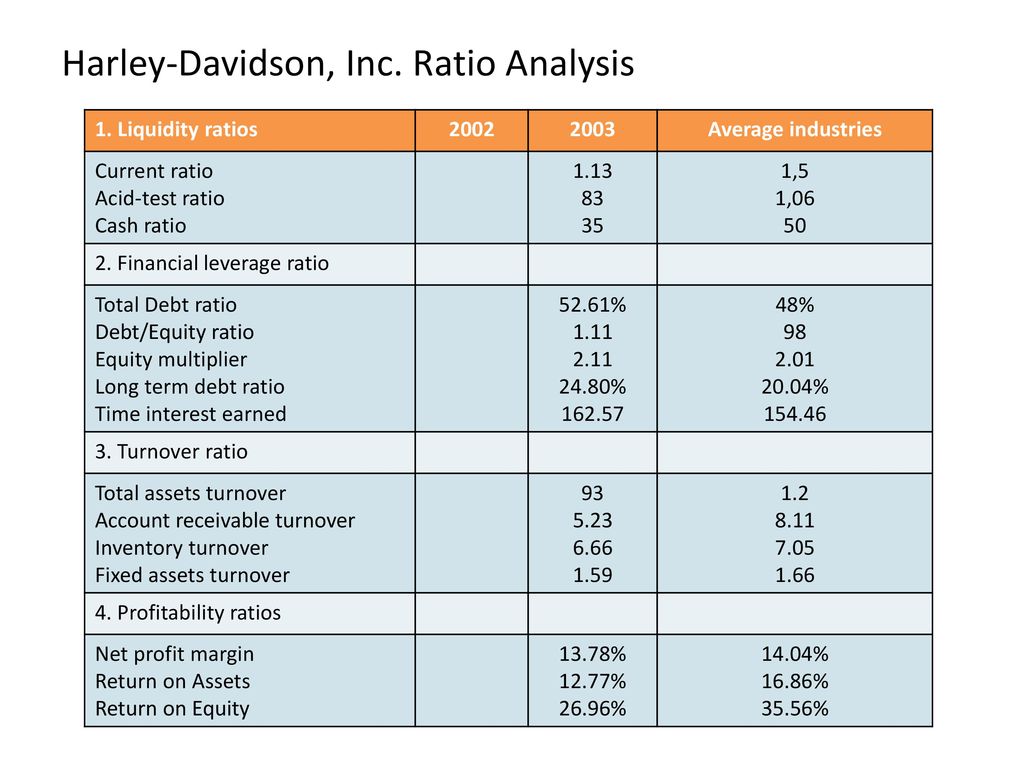

Its consistently high current and acid-test ratios prove that in the short run the company is in a strong position to meet its obligations which would be especially useful in the case of another economic downturn.

Harley davidson financial analysis. ANALYSIS Harley Davidson Zach Jones 1. Is significantly higher than the average of its sector Automobiles. A Strategic Audit Analysis.

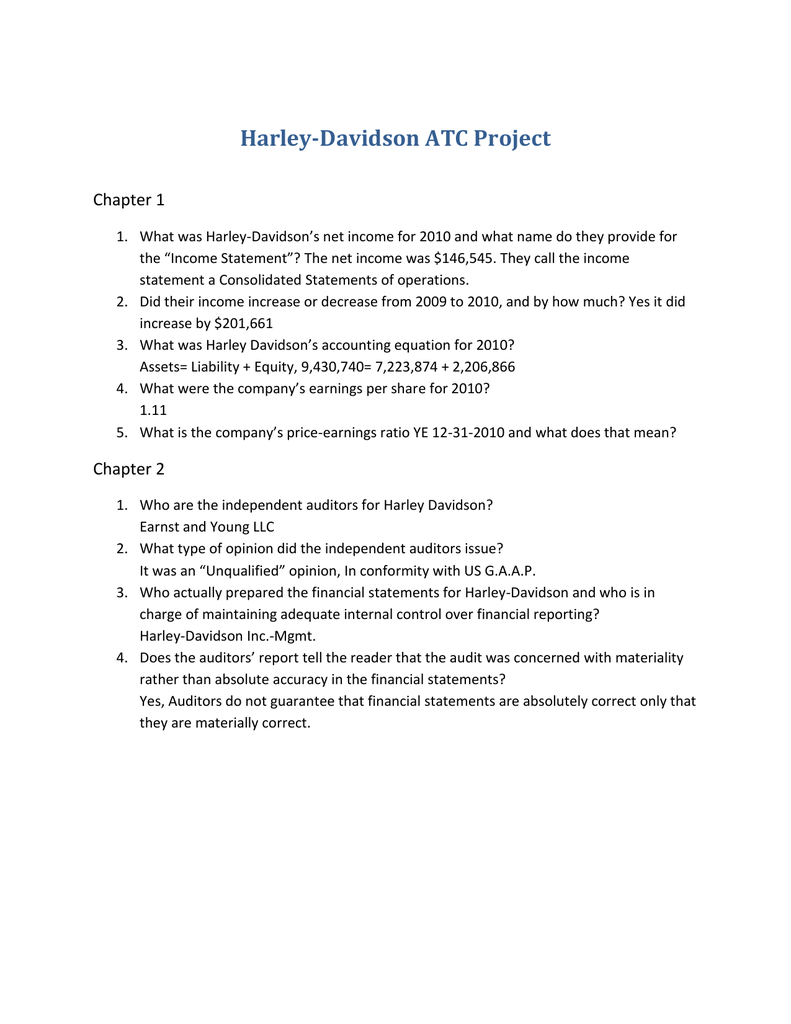

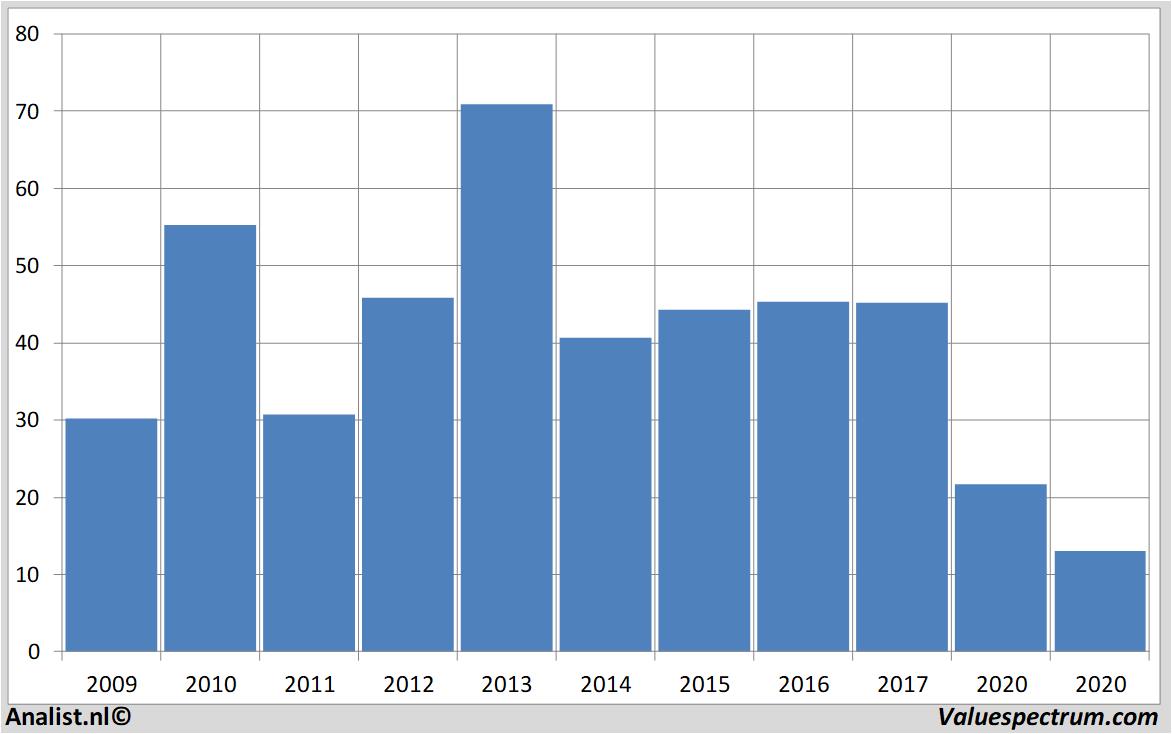

This table contains critical financial ratios such as Price-to-Earnings PE Ratio Earnings-Per-Share EPS Return-On-Investment ROI and others based on Harley-Davidson Incs. After peaking with 6. This project is for the FA -18 Financial Management Course at Wisconsin Luther College.

Harley-Davidson manufactures heavyweight motorcycles as well as a complete line of parts apparel and accessories for motorcycles. The net profit of the company was USD 59911 million during the fiscal year 2011 an increase of 30883 over 2010. The Motorcycles Related Products segment and Financial Services.

Performed a ratio analysis of the financial performance of two competitors and compared them to H-D. The Investor Relations website contains information about Harley-Davidson USAs business for stockholders potential investors and financial analysts. EBTEBIT The companys operating income margin or return on sales ROS is EBIT.

AUG 2011092712 1 2. This will be 100 for a firm with no debt or financial leverage. Check the Dupont Ratios Analysis of HOG Harley-Davidson Inc.

Is the parents company to companies that form a group and do business as Harley-Davidson Motor Company. Is lower than its historical 5-year average. Harley Davidson Strategic AuditPresented to.